SBA Disaster Assistance

If you are in a Presidential Declared Disaster Area FEMA registration is ALWAYS the first step. If you haven’t registered yet please click here. Also check out the FEMA information on this website.

For Non-Presidential Disaster Declarations you can apply directly with SBA.

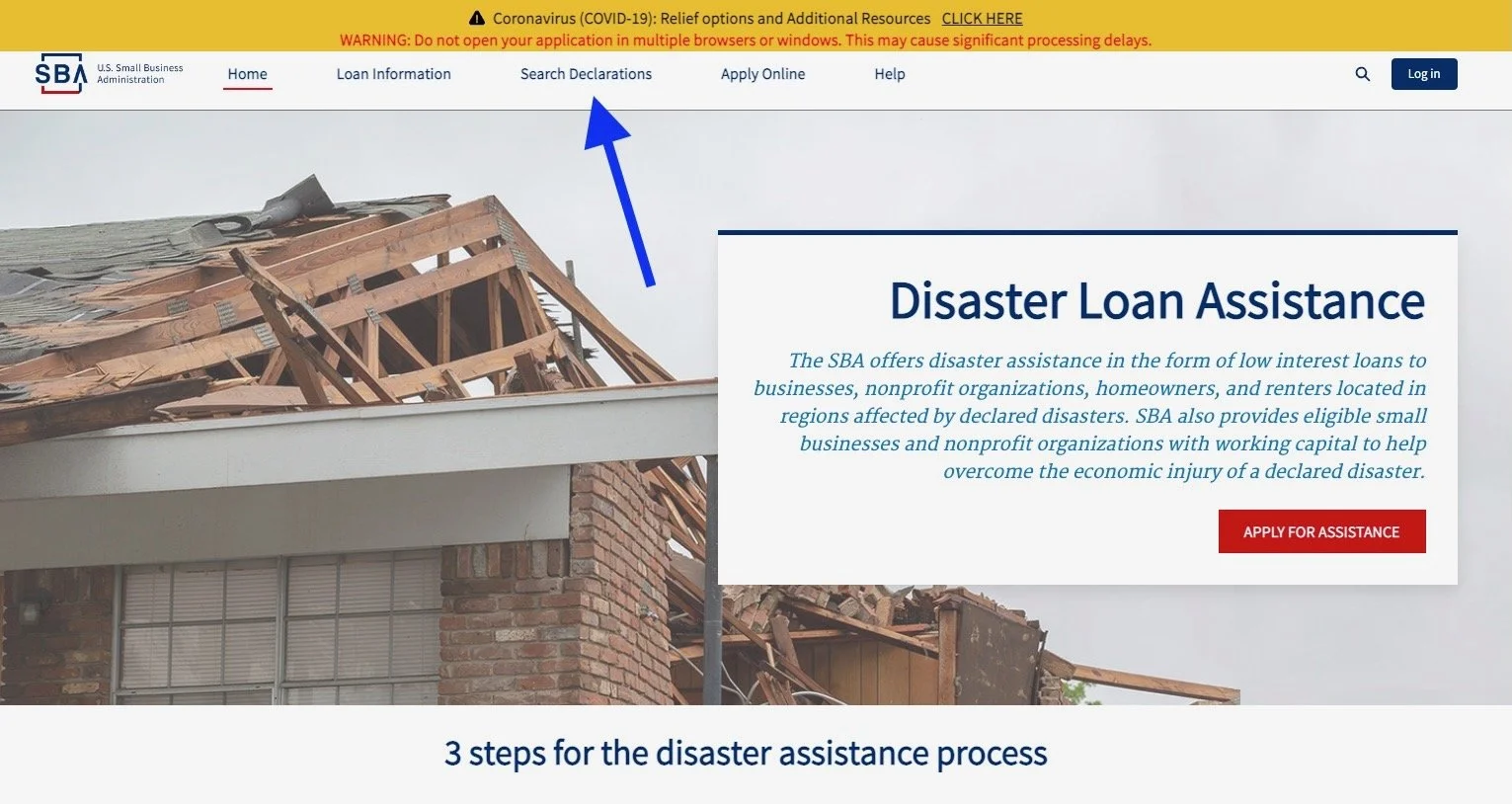

For an SBA Disaster Assistance Loan - you can apply online at: Disasterloan.sba.gov

or you can call 800.659.2955.

How do I know if my damaged property is in a Disaster area?

Go to disasterloan.sba.gov

Click on the link in the top row that says Search Declarations.

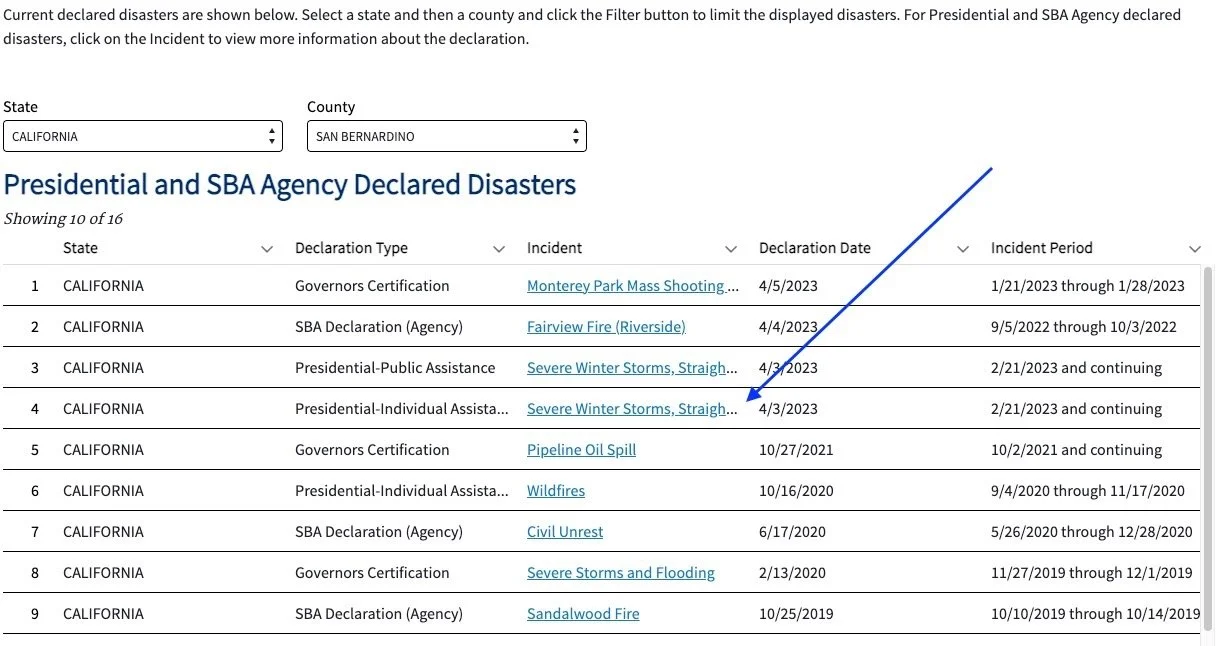

Select on your state and county.

Under Declaration Type you will see: Presidential-Public Assistance; Presidential-Individual Assistance; SBA Declaration (Agency); Governors Certification; etc.

For most home owners, business owners and renters you will be looking for “Presidential-Individual Assistance.”

Under the Incident section you will see a general description of the type of disaster and a link to click on in. The example we are using is for San Bernardino County - Presidential-Individual Assistance - Severe Winter Storms, Straight-line Winds, Flooding, Landslides, and Mudslides.

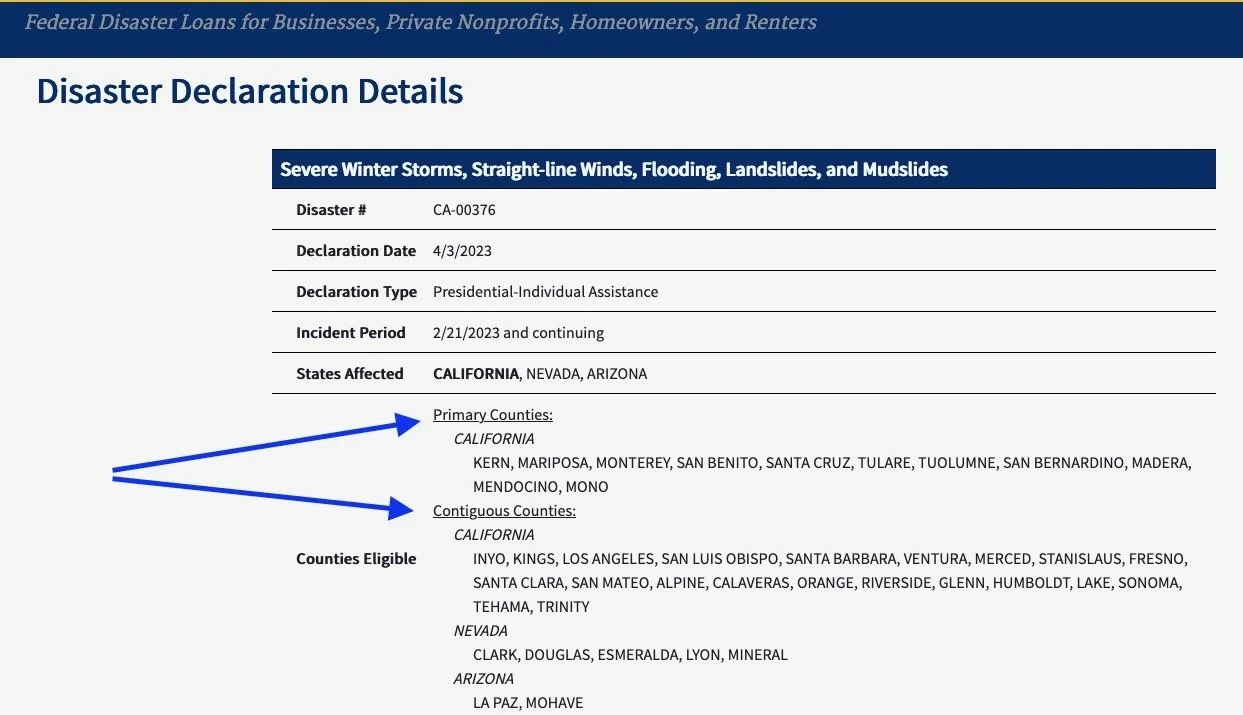

You will now be in the Disaster Declaration Details page and that will tell you:

Disaster #

Declaration Date

Declaration Type

Incident Period

States Affected

Counties Eligible for assistance which will include a listing of the “Primary Counties” and the “Contiguous Counties.”

From here you can scroll down and see the “Files” section and ofter there are a large number of documents including:

Fact Sheet

Press Release

Disaster Declaration

Disaster Declaration Amendments

Resources for Businesses

Language specific documents

Etc.

Disaster Recovery Center - Twin Peaks - 675 Grandview Rd, Twin Peaks, CA 92391 - UNFORTUNATELY, it appears that FEMA/SBA have closed this location. At least for the Holiday Weekend. We will be checking it on Tuesday.

Disaster Recovery Center is open Sunday through Friday from 9:00 AM to 7:00 PM

For your SBA Disaster Loan Application you will need:

Social security number.

Pre-disaster damaged address.

Current mailing address.

Current telephone number.

Current email address.

Insurance information.

Total household annual income.

Description of losses that were caused by the disaster.

SBA Disaster Loan - Three Step Process

Application Assistance:

Often Disaster Loan applicants, especially, business people are not aware of the detailed information that is routinely required in order to assist the assigned Loan Officer as they do their best to approve your disaster assistance loan.

Loan Officer, in fact, all of the Professionals at the Small Business Administration are looking to serve. They work every day doing their best to help people who have suffered from disaster of all kinds throughout the country.

That’s why we want to get the best, most accurate and reasonably detailed information to them as soon as we possibly can. That gives them the best chance to approve and rapidly process the loan and put you on the path to recovery.

Unfortunately…there are far too many people out there who say they can help you get an SBA Disaster loan, for a price. Often they charge hundreds of dollars for simply submitting a basic application. Something that you can easily do all on your own!

Now there are times when some home owners, residential business owners (people who have 1 or more properties that they rent as a business) and various business owners might actually need assistance putting together their applications. Routinely, this level of assistance is something that the SBA will provide at no charge. It’s a basic part of what their Federal Disaster Officials called “Loss Verifiers” and/or “Construction Analysts” do.

However, there are times, especially when a large disaster has affected a large number of people that the shear weight of all of the applications makes it really difficult for every application to be given the full amount of time and attention it deserves.

So…there is the possibility that in the near future we might be able to get some former Federal Emergency Response Officials also known as Loss Verifiers and Construction Analysts with the SBA to assist you directly.

How much will it cost?

Well that will depend, if this information is of interest to enough people who come to this website, then we will likely offer businesses an opportunity to sponsor this website. If that happens, we will be able to provide much of our assistance at no charge to the disaster victim. With some business and complex residential business applications we will likely need to charge a nominal fee depending on the complexity of the application.

Just so you know…some loan applications are very complex, take days or even a week for experts to prepare and can be for tens of millions of dollars!

If you would like assistance on your application please use this websites chat system to let us know and we will see what we can do.

SBA home owner, renter basic requirements:

The disaster damage must be directly caused by the declared disaster.

The damage residence must have been your primary residence at the time of the disaster or your family members were living in the residence at the time of the disaster or you were renting the residence at the time of the disaster (Residential Business application).

SBA must be able to verify your identity.

SBA must be able to verify your home ownership, rental occupancy, business ownership at the time of the disaster..

Assistance for your disaster caused damage or needs cannot be duplicated by insurance or other sources.

The person who applies for the household must be a US citizen, I noncitizen national, or qualified alien.

When a family or household has members with varying citizenship status, assistance may be available if at least one household member, including a child, is a US citizen, non-citizen national or a qualified alien.

How does the process work?

Once you have completed your registration and processing information with FEMA routinely you will be directed to apply for a Disaster Assistance Loan with the SBA.

You will go online or to a Disaster Recovery Center and fill out your application.

You will be contacted by an SBA Loss Verifier/Construction Analyst who will discuss your disaster damages with you. That person will then submit the information for review and it will go to the Loan Processing department.

You could be contacted by a Loan Officer or Case Worker who might request documentation or provide you with additional information or instructions.

You will be contacted by an SBA Loss Verifier/Construction Analyst who will set up a time to meet you or someone you ask to be your representative at the location where the property was damaged. After the onsite visit the Loss Verifier will submit the information for review and then it will go to the Loan Processing Department.

You will be contacted by a Loan Officer or Case Worker and proceed with the loan process.

Unfortunately, there are no real time frame estimates and the time required to process an application can be very different from application to application. A lot depends on how quickly you are able to provide the required information, documentation and coordinate with the SBA personnel who are working to assist you in the processing of the application.

What is the interest rate for the Disaster Loan?

The key person to obtain this information from is the SBA Loan Officer. However, to get an idea of what the interest rates could be you can go to the “Disaster Declaration” (this link is for Disaster Number CA-000376 that we have been using as an example) sheet and scroll down until you see “The Interest Rates are:” It will list:

Homeowners with Credit Available Elsewhere

Homeowners without Credit Available Elsewhere

Businesses with Credit Available Elsewhere

Businesses without Credit Available Elsewhere

Non-Profit Organizations with Credit Available Elsewhere

Non-Profit Organizations without Credit Available Elsewhere

For Economic Injury:

Businesses & Small Agricultural Cooperatives without Credit Available Elsewhere

Non-Profit Organization's without Credit Available Elsewhere

Businesses and Non-Profits:

Nearly all businesses can apply for a Disaster Assistance Loan. Even if they did not have any physical damages to their business. That’s right, many businesses suffer from Economic losses that can be every bit as devastating as having your business building destroyed by a hurricane, tornado, flood, or even under the weight of an extraordinary amount of snow (as we recently saw in San Bernardino County, California). When that happens these affected business can apply for an EIDL. That is and Economic Injury Disaster Loan.

With many disasters this can be the most under utilized form of assistance to businesses that have suffered financial losses as a result of a Declared Disaster.

Physical Damage Disaster Loans:

With many businesses where the immediate impact of the disaster is felt is with the destruction of their physical property. Real estate, leasehold property (for those businesses that rent or lease their business location), furniture and fixtures, machinery and equipment, business supplies, business vehicles, and inventory (products sold directly to customers).

Each business can be very different!

And the amount of detail and time required for the proper presentation of losses for the Loan Officer can be extremely varied. In short the key is to be as detailed as you believe is reasonable for the level of disaster damages you are reporting.

In the case of an auto shop that suffered roof damage from high wind and rain, the information required is straight forward: proof of ownership of the structure, square footage of the structure, and what was damaged on the roof (i.e. roof covering, sheathing, insulation, soffit & facia, gutters and downspouts).

In the case of an auto shop that suffered flooding to 3 feet above the shop floor, we have a vastly more detailed list of damages that are going to include the real estate (i.e. drywall, insulation, trim) and the list of all of the equipment and supplies that were damaged. Jacks, lifts, all kinds of mechanically tools, diagnostic equipment, compressors, fluid delivery systems, not to mention business computers, communications equipment, and business vehicles, etc.

The key is be as specific as you need to be in order for you to be confident that the Loan Officer is going to be able to recognize your losses and provide you with a disaster loan that will allow you to recover and continue your business operations as fast as reasonably possible.

Routinely, its best if you have a designated person from your business or non-profit that will be the primary contact for the SBA Disaster Assistance Loan Process. This will be the person who has collected the information, if very familiar with the damages that were suffered. Has immediate access to the documentation that will be required and/or is able to quickly access it and then works with the various SBA personnel who will be assisting with the applications process.

Can I apply for an SBA Disaster Loan if:

I don’t live in the home. My family members do. Ans: Yes

I rent the property to tenants, but I don’t have a formal business and EIN. Ans: Yes

I rent and my furniture and electronics were destroyed. Ans: Yes

My primary car was damaged. Ans: Yes

My home or apartment was not damaged, but my car was at work and was. Ans: Yes.

There was no damage to my home. Only the fencing and landscaping. Ans: Yes.

The only access road to my house was damaged. Ans: Yes.

The boat I live in was damaged: Ans: Yes

The RV that I live in was damaged: Ans: Yes.

The professional tools/equipment/supplies that I had at home and use for work were damaged. Ans: Yes.

I have a home based business and business property was damaged. Ans: Yes.

The SBA has been providing Home Owners, Renters, and Business Owners with disaster assistance loans for decades and there are a range of disaster damages that are frequently not covered by insurance that the SBA may be able to offer a Disaster Assistance Loan for.

Are SBA Disaster Assistance Loans forgivable?

Unfortunately, no. SBA Disaster Loans must be repaid.

This is an area of continuing confusion after the Federal and State efforts to provide assistance during the COVID pandemic. With the SBA Disaster Assistance Loan the loan must be repaid. Often after receiving the loan funding there is a 12 month period of time before monthly payments are required. During that time, it is important to note that the interest is continuing to accrue.

Appeals:

During disasters as much as the Small Business Administration and its dedicated disaster personnel want to help…there is always the possibility that something might go wrong.

That’s why they have an appeals process and its also the reason why you have Federal and State political representatives.

Some of the reasons that an application may need to be appealed:

You were unaware of the potential for applying for a disaster loan and missed the deadline. Unfortunately, all too often disaster victims are not aware of the fact that they can apply for FEMA and/or SBA Disaster Assistance and they miss the opportunity, because by the time they find out the deadline is already passed. We encourage you to not simply give up. And its possible that we might be able to help. If this has happened to you, please start a chat with us.

You submitted incorrect information that you believed that was correct at the time you submitted your application. You will want to reach out to your Loan Officer or Caseworker if you haven’t already done that. Or call the SBA Customer Service Center at 800.659.2955.